Shoffr is a Bengaluru-based EV cab service exclusively operating in the airport transfers sector - an EV alternative to ‘The Airport Taxi’. Everyone - from travel enthusiasts to startup founders - seems to be using Shoffr for their Bangalore airport rides. However, what sets Shoffr apart is not its clientele but its IndiGo-esque operating model. Does Shoffr have what it takes to build a successful and profitable mobility startup in India?

Shoffr is a relatively young startup that was started by Vikas Bardia and Kislay Verma in July 2022. They have been in operation for around a year and have currently scaled to an estimated 9 EV vehicles. Currently, Shoffr operates exclusively in the premium airport transfers space in Bangalore, offering rides to and from Kempegowda Airport. It has plans to expand to other cities while limiting itself to the airport transfer space.

Image Source: https://twitter.com/shoffr_in/header_photo

I. Market Size

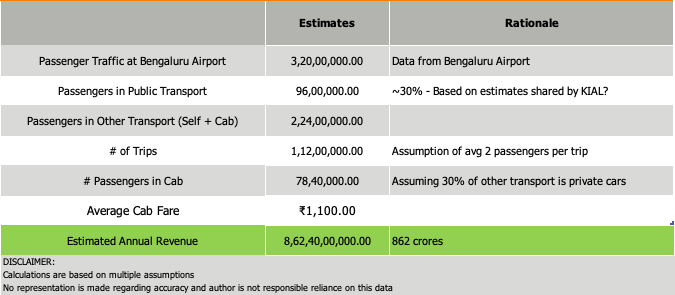

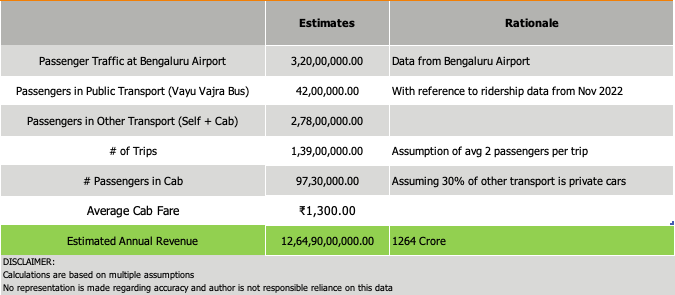

Shoffr's current focus is the airport taxi market. This market size, based on a back-of-envelope calculation, is anywhere between ₹ 850 crores (conservative) to ₹1250 crore (optimistic) for Bengaluru in 2023.

Conservative:

Optimistic:

From 2022 to 2023, the Bengaluru Airport saw a 96% growth in passenger traffic. With the increase in passenger handling capacity – the opening of Terminal 2, the passenger traffic is likely to see healthy growth in the coming future. Therefore, the market for airport cabs may see good growth.

II. Strategy

Shoffr is a relatively young start-up (< 1-year-old) and is still experimenting with the product-market fit and its business model. Until a startup establishes a market for itself and achieves a certain scale, its business model is usually optimized for convenience. This is especially true for non-tech startups. Therefore, Shoffr’s current business model is likely to change after a certain point as it optimizes growth and/or costs.

Shoffr is positioned as a premium offering within the Bengaluru airport taxi segment. It is priced roughly 40% above Uber rates and 20% above BluSmart (also EV cabs). To represent itself as a premium player, Shoffr has chosen to exclusively purchase BYD E6 compared to BluSmart’s fleet of Tata XpresT EVs or Uber’s Swift Dzire/ Toyota Etios.

In addition to the vehicle, there are also other practices including light touches in the interior like a travel organizer with water bottles, tissues and toffees, driver training in soft skills, strict SOPs on car cleaning and a rigorous maintenance/servicing schedule.

Shoffr operates primarily in the B2B space with corporate clients, but it has a growing number of B2C customers. At present, Shoffr may be generating 75-80% of its revenue from corporate clients. It is likely that these corporate clients are startups since procurement for large corporates is usually cost-based. Further, Shoffr would have to replace already entrenched vendors.

The key differentiator for Shoffr may be their extremely high asset utilization ratio. Shoffr cars do an estimated 8000-9000km per month. This roughly translates to an average of 300 km per day per vehicle. Assuming an average distance travelled of 40 km per trip, this translates into approximately 8 trips per day.

Therefore, the overall Shoffr strategy seems to be an operationally optimized premium offering in the airport taxi segment. Think Vistara operated by Indigo’s team.

III. Business Model

Asset Ownership

Shoffr is currently operating like a traditional cab service like Meru or BluSmart. Shoffr has complete ownership over the 9 vehicles currently operating in its fleet. This is an asset-heavy model and the ownership risks like vehicle breakdown or repairs are the sole responsibility of Shoffr.

Given its currently small scale, Shoffr likely purchases its vehicles from a retailer and does not have a direct partnership with the company. Since it has already purchased 9 cars, Shoffr may be receiving a 2-3% discount, ₹50,000 - ₹75,000 cash discount on sticker price from the retailer.

The vehicles are estimated to be financed with a 15-20% down payment and a vehicle loan. Shoffr is unlikely to obtain preferential rates for its loans at its current scale, therefore it can be assumed that the vehicles are financed at an interest of 12%.

Personnel

The majority of Shoffr’s personnel currently are their drivers. These drivers are recruited as contract workers. However, I could not ascertain whether the drivers are contracted directly by Shoffr or through an outsourcing agreement with a third-party agency. It should be the latter as it would reduce costs associated with finding and managing drivers.

Shoffr employs 2 drivers per vehicle each for a 12-hour shift with the first shift starting from 9:00 to 21:00 for 6 days a week. It is estimated that Shoffr pays their drivers around ₹25,000 - ₹30,000 per month. There may be some variable component to this compensation, around 20%, either for # of trips driven or for # of days worked. There may be a total of 20 – 21 drivers.

There may be an operations manager, who also acts as a stand-in or substitute driver in case of emergencies. The operations manager would be expected to train driver partners, manage daily operational concerns, document and inspect vehicles and create SOPs for cleaning and other general activities. This manager is likely compensated at ₹60,000 - ₹70,000 per month.

Technology

Technology does not appear to be a focus area for Shoffr at this moment. It has a relatively dated web application for consumer booking or bookings can be done through WhatsApp. The website is likely integrated into a primary ERP-like application that stores user information, populates the travel/trip database, shares booking updates with the customer via SMS, and provides basic trip details like Pick/Drop location and time to the drivers through a driver-side app. They are using Google Maps API for route and location mapping.

Since its primary clientele has been corporate customers, Shoffr has likely been receiving payments via monthly invoicing through NEFT/cheque. Therefore, the payments system may not have been set up for B2C businesses where they relied upon cash-on-delivery payment. However, the rapidly growing B2C customer base has led Shoffr to work on integrating a payments system into their web application for the prepayment option.

This is a work in progress, but they seem to have chosen integration with the PayTM payment gateway. The payment integration is a WIP and was likely introduced recently to cater to the growing B2C customer base.

Since technology is not an area of focus for Shoffr at this moment, route optimization or driver allocation likely seems to be done manually on the backend.

Charging Infrastructure

As calculated above, Shoffr makes an average of 8 trips per day. Since the shift timings are from 9:00 to 21:00, the first shift captures the evening/night airport traffic, and the second shift captures the early morning airport traffic. Therefore, it is safe to assume a uniform distribution of trips across shifts. So, each shift consists of an average of 4 trips.

The average actual paid travel time for each trip may be assumed to be 70-80 minutes with an approximate waiting and miscellaneous time of 30 minutes. In addition to the paid travel time and waiting time, unpaid travel time is also an important component. Conservatively, we can assume unpaid travel time adds at least 20% to the time.

Therefore, the total trip time is around 110*1.2 = 130 minutes or 2 hours and 10 minutes. For 4 trips, the total time spent is approximately 9 hours. This leaves less than 1 hour between trips for driver exchange, vehicle cleaning, driver breaks and other miscellaneous activity.

To tackle the paucity of time for a traditional 8-9 hour normal charging, Shoffr relies primarily on fast charging. Per the SOP, drivers have been directed to plug into a fast charger between every trip and take their breaks during the charging process.

To facilitate easy access to fast chargers across Bengaluru, Shoffr has tied up with several Shell petrol pumps that also provide fast chargers and access to rest stop facilities like washrooms for the drivers. By opting for a dispersed charging strategy instead of a central charging hub like BluSmart, Shoffr is minimizing the unpaid travel time for their vehicles and saving on costs associated with the central hub.

Other Operations

Shoffr does not appear to have designated parking spots for its vehicle. This may be a direct result of the high asset utilization model where the cabs are expected to be constantly on a paid trip.

However, there does appear to be a central shed where presumably the drivers are exchanged. Faulty vehicles are likely to be parked here until they are sent for repairs. This place also likely serves as a meeting room for discussion with drivers and operational briefings. The operations manager is likely to be functioning out of this space.

With its heavy usage, Shoffr also likely services its vehicles frequently approximately once every 2 weeks for a minor service/ inspection through the designated BYD’s service centre.

Marketing

Shoffr may have little to no marketing expenses. The B2B sales were likely obtained organically either by directly reaching out to a potential client or through a referral by an employee of the potential client. In either case, there are little to no marketing expenses.

The B2C segment, on the other hand, initially relied on word of mouth but has since been able to generate organic coverage in reputed magazines like The Ken or established news sources like Moneycontrol or Times of India.

Both the B2B and B2C segments of Shoffr should have close to nil CAC (Customer Acquisition Cost).

IV. Unit Economics

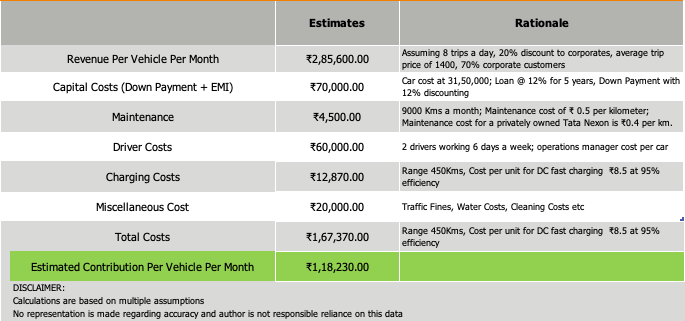

With high levels of asset utilization, Shoffr is likely seeing healthy contribution margins. Per my calculations, Shoffr sees an average contribution of approximately ₹1,20,000 per month per vehicle.

BYD:

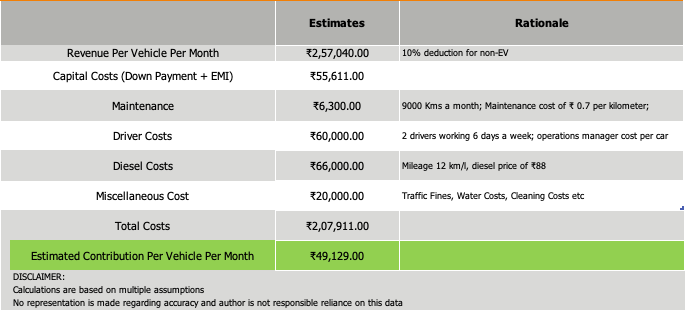

We can also draw a comparison to Innova Crysta. Assuming Crysta costs ₹25,00,000 on the road in Bengaluru, under the same high asset utilization model, we would get a contribution margin of ₹50,000 per month.

Innova Crysta:

The healthy contribution margins for BYD could allow Shoffr to scale at a decent pace even without raising external capital, that is, by bootstrapping.

V. Threats & Weaknesses

Scalability

Shoffr's current business model lacks scalability for multiple reasons:

First, the capital-intensive nature of the business model. Since Shoffr owns the vehicle it operates, scaling is capital-intensive. While this asset-heavy model is not a concern at this juncture due to healthy contribution margins, Shoffr might be susceptible to a price war. Consider that BluSmart, an EV cab service, is rapidly expanding its premium fleet comprising MG ZS EV. It is unlikely that Shoffr would be able to continue charging a premium of 20-40% to BluSmart. A price correction would rapidly bring down the contribution margin and make it difficult to sustain an asset-heavy model unless other costs are heavily optimized.

Second, the dispersed charging model. Currently, Shoffr cars are primarily charged in Shell petrol pumps across Bengaluru. This is not a scalable solution as most petrol pumps have 2-3 chargers. This is likely to create major availability issues for charging points with increased EV adoption and as Shoffr scales.

Third, driver fatigue. Shoffr is susceptible to driver fatigue that sets in during the 12-hour shifts with rigorous daily travel. The drivers would likely turn exhausted, and irritable with their driving and attention span suffering. In time, Shoffr would have to tackle the heavy workloads likely by switching to an 8-hour shift versus the current 12-hour shift. Alternatively, if Shoffr does not address this situation, it may face high driver attrition.

Customer Experience

From a B2C customer journey perspective, Shoffr is quite lacking:

First, the booking experience and interface are buggy and often throw up errors. Further, bookings made through WhatsApp may be at risk of being missed.

Second, the high utilization rate leaves Shoffr susceptible to operational concerns. There is usually no functional substitute available in case a car is urgently needed. For instance, if a car breaks down, there is usually no redundancy or contingency plan that can be instituted without adversely affecting customer experience. With priority for B2B customers, B2C customers may face issues.

Policy Risks

Behind the high contribution margins for Shoffr, lay certain risks and costs that may not be easily evident:

First, the EV policy by the Karnataka Government exempts road taxes and other charges for EVs. If this policy is withdrawn, there may be a large increase in on-road prices for BYD E6 anywhere to the tune of 20-30%.

Second, is the battery replacement risk. In EVs, batteries constitute a significant percentage of the vehicle costs. A single battery replacement could effectively double the payback period for a vehicle. While this is currently not a concern as BYD is providing a battery warranty of 5,00,000kms or 8 years in India. However, the ‘charge-whenever-you-get-time’ SOP for Shoffr leads to inefficient charging cycles and increased battery degradation. If BYD shortens its warranty, Shoffr may end up facing significant battery replacement costs.

VI. Ideas for Growth

Revenue

As discussed, Shoffr is likely catering to startups as corporate clients and a growing number of B2C customers. Shoffr can consider the following methods to increase revenue:

1. Large Corporates: Shoffr could reach out to large corporates and pitch itself as a low-carbon alternative to existing cab services. It would be helpful if Shoffr could provide accurate carbon data like emissions avoided and, register themselves on a portal like CDP.

2. B2C Growth: For B2C, Shoffr currently relies on organic growth with little to no investment in marketing. Shoffr should consider some means of driving growth in this segment either through marketing or, at least, instituting a referral program.

3. Tie-Ups with Hotels: Shoffr can consider tying up with hotels or service apartments that cater to corporates for airport transfers.

4. Tie-ups with Credit Card/ Loyalty Programs: Tying up with various credit card providers and/or loyalty programs could provide an additional source of customer generation and help with brand-building.

5. Advertising & Product Placement: Shoffr could provide advertising space to companies looking to attract its high-spending premium corporate clientele.

Financing

As discussed, to become mainstream, Shoffr would rationalize its current fares and reduce susceptibility to price wars. One way would be to capture economies of scale. Today, it is adding 1-2 cars a month to its fleet which does not help. Shoffr needs to increase the pace at which it is adding vehicles.

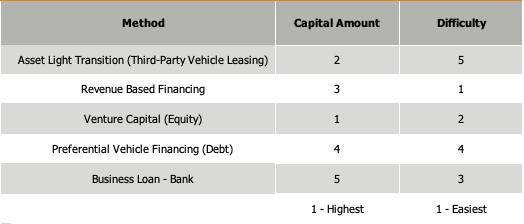

Depending on how comfortable the founders of Shoffr are comfortable with diluting equity, they may opt for Venture Debt like Revenue-based Financing or traditional equity investment through Venture Capital. With its healthy contribution margins, Shoffr may be able to raise significant venture debt through revenue-based financing at effectively 14% - 16%.

Charging Infrastructure

Shoffr’s dispersed charging model may impede scaling and would require an alternative. There are a few ways that this could be solved:

1. Increase partnerships: Shoffr could sign partnerships with multiple different vendors for priority access to charging and rest-stop facilities for its drivers.

2. Exclusive Charging Arrangements: Shoffr could lease or secure exclusive rights to charging stations in their high-frequency areas.

3. Central Hub: Shoffr could build/lease a central hub for charging. Coupled with route optimization software, this may help Shoffr reduce the number of charging cycles while centralizing its charging operations without adding significant unpaid travel.

Costs

Shoffr can undertake the following measures to benefit from scale and reduce costs:

1. Preferential Prices: Shoffr could seek preferential prices through BYD directly through an exclusivity agreement. It could also agree to provide BYD with additional travel data. The preferential rates can be obtained both for the purchase and servicing of vehicles.

2. Preferential Financing Rates: Shoffr could seek preferential interest rates for its vehicle financing.

3. Tie Up with Airport Toll Operator: Shoffr can tie up with the toll operator to obtain monthly passes/ preferential toll rates for its vehicles.

4. Preferential Charging Rates: Shoffr may be able to buy electricity at preferential rates from private solar-powered charging stations during the day. By planning charging times based on electricity prices, charging costs could be reduced.

Policy Risks

As discussed, the key policy risks for Shoffr are the withdrawal of Karnataka's EV policy and the reduction in warranty offered by BYD for its vehicles. There are two means of tackling this risk:

1. Frontloading Vehicle Purchases: Shoffr could frontload their vehicle purchases to take advantage of the existing policies. In other words, scale quickly before the policy changes.

2. Shorter Ownership Cycles: Shoffr could seek to reduce maintenance-related risks by opting for a shorter ownership cycle, that is, by replacing the car after 2-3 years of use. This might slightly increase ownership costs but that could be offset by reduced risk of high maintenance costs like battery replacement.

VII. References

4. https://www.team-bhp.com/forum/electric-cars/256031-byd-e6-electric-mpv-ownership-review.html

5. https://www.rushlane.com/tata-nexon-ev-owner-shares-cost-details-after-85000-km-12452962.html

6. https://www.kazam.in/category/blog/how-much-electricity-does-it-take-to-charge-an-electric-car

Thanks for writing this review. Very helpful!

Hi Utkarsh,

You did a great job of explaining the Shoffr's value proposition and how it plans to scale.

I have a few thoughts. First, I agree that getting external capital before scale can be risky. However, I think Shoffr is in a good position to scale itself before securing a debt financing, the bootstrapped scale will help get a better deal later, similar to what BluSmart did.

Second, I think Shoffr should focus on expanding to more cities targeting the premium routes before scaling to premium-mass use cases. This will help the company build its reputation and generate brand awareness. In the meantime, Shoffr should build loyal user bases by opening up the service to other ride segments, such as intracity long-hour use cases and rides for frequent users. This will help the company generate additional revenue and understand the demand better.

Thanks